Jan 15, 2026

How to Create Editorial-Led Growth for Financial Services

Averi Academy

Averi Team

8 minutes

In This Article

Use editorial-led content with AI, human oversight, and integrated compliance to build trust, generate leads, and measure ROI in financial services.

Updated:

Jan 15, 2026

Don’t Feed the Algorithm

The algorithm never sleeps, but you don’t have to feed it — Join our weekly newsletter for real insights on AI, human creativity & marketing execution.

The financial services industry faces a trust deficit, intensified by fintech competition and past crises. Editorial-led growth offers a solution by combining high-quality content with compliance and audience insights to build trust and authority. Key takeaways include:

AI's Role: AI tools streamline content creation but require human oversight for compliance and strategic alignment.

Content Strategy: Focus on targeted, authority-driven formats like whitepapers and research reports tailored to specific buyer journeys.

Compliance: Early involvement of legal teams and automated compliance checks minimize risks and ensure regulatory adherence.

Metrics: Track both operational efficiency (e.g., production speed) and business impact (e.g., lead generation, ROI).

Building the Foundation for Editorial-Led Growth

Identifying Your Target Audience and Content Goals

To stand out in the crowded financial services market, marketers need to dig deeper than surface-level demographics. It's essential to analyze career paths, professional networks, and wealth profiles to uncover what truly motivates your audience[6]. Instead of targeting generic roles like "CFO", focus on specific events, such as a new executive appointment or a liquidity milestone, which are more likely to trigger action[6]. These nuanced insights are key to creating content that builds trust and authority in a competitive space.

Form a content council that includes subject matter experts, sales teams, and product managers. This group can help identify recurring customer challenges and confirm which topics will resonate most[3]. Use look-alike modeling to find new prospects who share traits with your most valuable clients[6]. Then, align content formats with the buyer's journey: for example, use in-depth whitepapers for early research stages and conversion-focused pieces for later stages[2].

Integrate social media profiles with prospect records, segment your audience by trigger events, and prioritize channels with a proven track record of conversions. Once your audience triggers and content goals are clear, evaluate your current assets to identify any gaps that need to be filled.

Auditing Existing Content and Finding Gaps

Start by taking a full inventory of your content. Use website crawlers to catalog every URL, page, and asset across your site, emails, and social platforms[7]. Review each piece for clarity, relevance, and performance metrics[7].

Measure your content against five key benchmarks: Findability, Readability, Understandability, Actionability, and Shareability[3]. Classify each asset into one of three categories: Growth (content that drives revenue), Authority (content that builds credibility), or Innovation (content that experiments with new formats)[2]. This process helps you pinpoint areas where you're overinvested and reveals gaps that need attention.

Take a close look at your competitors’ themes, formats, and tone to uncover opportunities where your brand can lead instead of follow[1]. Work with your content council to score topics based on clear criteria, prioritizing both existing and new content by its strategic importance and potential impact[3]. Use an editorial calendar to identify scheduling gaps and ensure alignment with your business objectives[3][1]. For technical improvements, AI tools can monitor Core Web Vitals and identify internal linking opportunities to strengthen your topic clusters[2].

Meeting Compliance Requirements in Content Creation

In the financial services sector, compliance doesn’t have to stifle creativity. Instead, it should act as a built-in safeguard that keeps your content both engaging and compliant. Real-time compliance checks can save time and reduce costly revisions by flagging potential issues during the content creation process[8].

The stakes are high. Consider TD Bank’s record $3.09 billion penalty under the Bank Secrecy Act in 2024, which underscores the importance of getting compliance right[10]. As one compliance expert from Pipedrive explains:

"Effective compliance management isn't about saying 'no' to business opportunities. It's about finding compliant ways to say 'yes'"[12].

To streamline the process, involve legal and regulatory teams early in your content strategy discussions. This proactive approach avoids last-minute bottlenecks and ensures smoother production workflows[9][10]. Leverage AI tools to automate disclosures, flag risks, and maintain consistency across channels[8][13]. Before diving into creative work, conduct a thorough regulatory analysis to map out requirements from bodies like FINRA, SEC, and GDPR[12]. Collaborate with internal experts to produce content that’s not only credible but also aligned with compliance standards, steering clear of the generic tone often associated with AI-only material[11].

One example of success is the B2B fintech company Yapily, which achieved 2.8x growth in organic leads by November 2025. Their expert-led content strategy ranked for 94% of key buying keywords while adhering to strict regulatory requirements[11].

Creating an Efficient Editorial Workflow

Assigning Roles and Responsibilities

An effective editorial workflow begins with clearly defined roles. In financial services, this means having writers to create content, editors to ensure consistency and quality, and social media teams to manage distribution [1]. The complexity of financial topics and regulatory requirements often calls for additional expertise. Building a team that includes data analysts to validate statistics, business analysts to align content with revenue objectives, and legal or compliance experts to review for regulatory adherence is essential [5]. As AI becomes more integrated into workflows, financial institutions are also introducing new roles: Builders (tech specialists managing AI models), Shapers (experts embedding AI into processes), Users (interpreters of AI outputs), and Governors (those ensuring AI compliance and ethics) [5].

To streamline the process, assign responsibilities directly within your editorial calendar. Clearly outline who is responsible for research, drafting, compliance reviews, and final approvals for each project [1]. Use a detailed intake form for internal requests, requiring stakeholders to specify the target audience, goals, and key messages before your team commits to the task [3]. This approach helps avoid scope creep and keeps the focus on strategic priorities.

Organizations that adopt transparent content scoring methods report better outcomes. By ranking assignments based on qualitative and quantitative factors, teams can prioritize effectively and provide clear reasons for rejecting projects that don’t align with core objectives [3]. With 71% of CMOs citing budget constraints as a barrier to fully executing their content strategies [3], defining roles and responsibilities is a critical first step toward creating a workflow that aligns with business goals.

Planning a Content Calendar That Supports Business Goals

A successful content calendar requires distinguishing between two key tools: the Content Pipeline and the Editorial Calendar. The Content Pipeline should map out annual business milestones, product launches, and regulatory deadlines, while the Editorial Calendar focuses on weekly publishing tasks, assigning ownership and deadlines to each piece [14].

Early involvement of cross-functional stakeholders is key. Establish a Content Council made up of subject matter experts and product managers to validate topics and ensure technical accuracy [3]. This approach builds on the importance of specialized roles for compliance and precision, reducing the need for costly revisions down the line.

Content scoring can help prioritize efforts. With 62% of marketers finding it difficult to create content tailored to different stages of the buyer journey [14], map each piece to a specific stage - awareness, consideration, or decision. Use this framework to fill gaps in your content funnel and conduct quarterly audits of your tech stack to eliminate redundant tools [14].

A case study from Wyndly, a telehealth platform, highlights the impact of efficient workflows. By integrating AI-powered processes to scale expert-led medical content, Wyndly increased its monthly production from 40 to 200 articles. This led to a 20x increase in organic traffic (from 10,000 to 200,000 monthly clicks) and a 28% rise in organic customer acquisition, surpassing competitors like WebMD [2].

Setting Up Feedback Loops for Quality Control

Once your team and schedule are in place, quality control becomes the cornerstone of success. Start by defining your brand’s tone, voice, and style guide, and use these benchmarks to evaluate every piece [3]. A thorough QA process should catch typos, grammar errors, and factual inaccuracies, ensuring that all content meets the highest standards for authority and compliance [3].

Implementing a "human-in-the-loop" model can further enhance quality. While AI tools can handle research and initial drafts, human experts should oversee creative direction, strategic alignment, and final approvals [2][5]. This is particularly critical in financial services, where 70% of global executives express concerns about the traceability of AI-generated content [5]. Automate routine checks like grammar and plagiarism detection, but reserve human oversight for higher-level quality assurance [2].

Integrating workflow management and collaboration tools can significantly reduce compliance failures. For instance, financial services firms using such tools have seen compliance failure rates drop by up to 80% [15]. Prudential Financial, for example, achieved a 365% year-over-year increase in engagement by enabling marketing teams to self-serve routine assets through Adobe Express while maintaining brand standards [15]. Regular editorial-compliance check-ins ensure that your content stays aligned with evolving regulations [1].

Finally, track operational metrics like production speed and internal quality scores to identify and address bottlenecks before they disrupt workflows [2]. Companies leading in "Responsible AI" practices are nearly three times more likely to fully realize the benefits of predictive AI, with adoption rates jumping from 14% to 41% [5].

How to Use An EDITORIAL CALENDAR for An Effective CONTENT STRATEGY - Content Calendar Tutorial

Using AI-Powered Tools to Speed Up Content Production

Balancing speed with regulatory compliance is a critical challenge for financial services content teams, and AI tools are stepping in to address both needs effectively. By automating repetitive tasks - like audience research, competitor analysis, draft creation, and compliance checks - AI allows human teams to focus on strategic decisions and approvals. The secret lies in selecting tools that incorporate compliance safeguards from the outset. Studies indicate that AI platforms can handle 80% to 85% of compliance automation requirements[16], making the technology practical and ready for implementation. With AI integrated into the editorial workflow, content production becomes faster and more efficient at every stage. Here’s how AI transforms strategy, creation, and publishing processes.

Automating Content Strategy with AI

AI eliminates much of the manual effort involved in developing a content strategy. Instead of spending weeks analyzing keywords and competitor data, tools like Averi can scan your website to understand your business, products, and positioning. These tools then identify gaps in competitor content, pinpoint high-value topics, and generate a tailored content marketing plan aligned with your audience. What once required spreadsheets and input from multiple stakeholders can now be completed in minutes[2].

For financial services, the shift from periodic planning to continuous monitoring is particularly useful. AI-driven Regulatory Change Management (RCM) systems, for example, automatically track updates from agencies like the SEC and FINRA, mapping those changes to your internal policies and content[18]. As Kelly Housh from Bremer Bank shares:

"Every word makes a difference in regulatory compliance... so how it applies is very specific to your organization. Having Compliance.ai's software definitely makes my job more efficient."[18]

This ensures your content strategy remains aligned with the latest regulations without the need for constant manual reviews.

Creating and Editing Content with AI Support

Once the strategy is set, AI tools can draft content that aligns with your brand voice and compliance standards. A Component Content Management System (CCMS) is particularly effective here, as it uses pre-approved content "building blocks" to ensure that AI-generated drafts stay consistent with your organization’s guidelines[17]. This is especially crucial in financial services, where product descriptions and disclosures must remain uniform across all platforms.

Other industries have already seen significant gains in efficiency and engagement by adopting similar approaches, offering a roadmap for financial services to follow. Here, the "Expert-in-the-Loop" (EITL) model is indispensable. High-risk content, such as investment advice, is routed to human experts for final review, addressing concerns about AI traceability and accuracy[18][5]. Meanwhile, technical SEO tasks - like optimizing titles, meta descriptions, and schema markup - are handled automatically, ensuring visibility in both traditional search engines and AI-powered search tools[2].

Publishing and Tracking Content with AI Integration

AI tools that integrate directly with your CMS simplify the publishing process by eliminating the need for manual copying, pasting, and formatting. Platforms like Averi can publish directly to systems like Webflow, Framer, or WordPress, while also archiving content for future use. This creates a complete audit trail, including version histories, workflows, and formal approvals, to meet regulatory requirements[17].

A case study from Erie Insurance highlights the benefits of this approach. By adopting Adobe Experience Manager Guides in March 2025, they replaced outdated manual tracking systems, enabling their team to reuse content components across multiple publications. Automated review workflows helped them meet tight deadlines, and compliance failure rates dropped by up to 80%[15].

AI also transforms performance tracking into a continuous process. It monitors metrics like impressions, clicks, and keyword rankings in real time, offering actionable recommendations - such as identifying content to update or highlighting emerging trends. This "always-on assessment" provides the agility to respond quickly to market changes while staying compliant[16]. By streamlining both publishing and performance tracking, AI tools enable ongoing improvements across all content initiatives.

Measuring and Improving ROI from Editorial-Led Strategies

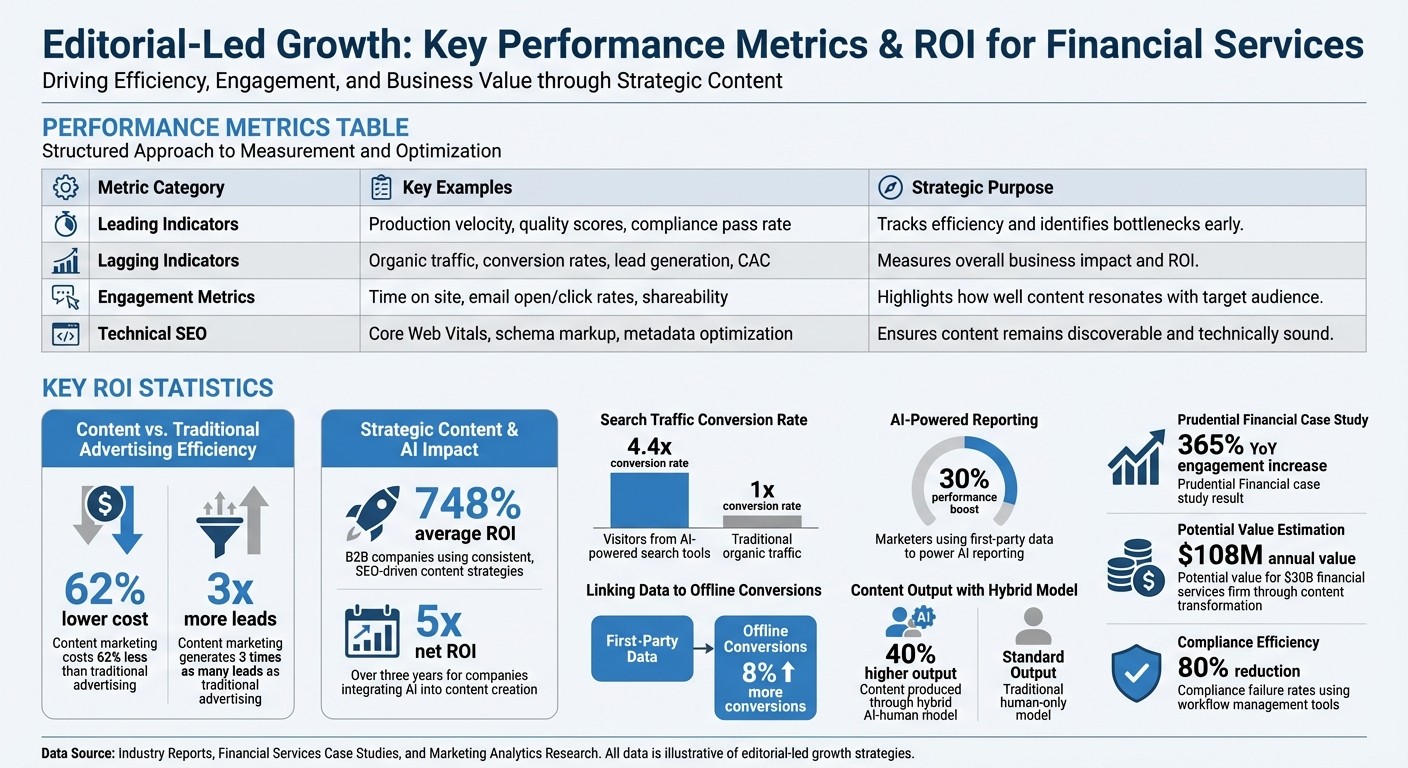

Editorial-Led Growth ROI and Performance Metrics for Financial Services

Tracking the right metrics is what separates successful programs from those that fall short. For financial services companies, it’s essential to look beyond surface-level indicators like page views and focus on metrics that directly tie to lead generation, sales, and customer retention [2]. Demonstrating return on investment (ROI) is not just about justifying budgets - it’s about completing a strategic feedback loop that drives trust and growth in the financial sector. To do this effectively, teams need to zero in on metrics that reflect both operational efficiency and tangible business outcomes.

Key Metrics for Tracking Content Performance

Measuring performance requires a mix of leading and lagging indicators. Leading indicators, such as production velocity, quality scores, and compliance pass rates, help assess operational efficiency early in the process. Meanwhile, lagging indicators like organic traffic, conversion rates, and customer acquisition costs reveal the broader business impact [2]. For high-net-worth and B2B audiences, engagement with "Authority Content" - think whitepapers, research reports, and detailed guides - often matters more than reaching a wide audience [2][6]. This is particularly relevant as 8 out of 10 online purchases in financial services involve multiple touchpoints before a conversion [19].

Here’s a quick breakdown of key metric categories:

Metric Category | Key Examples | Strategic Purpose |

|---|---|---|

Leading Indicators | Production velocity, quality scores, compliance pass rate | Tracks efficiency and identifies bottlenecks early [2] |

Lagging Indicators | Organic traffic, conversion rates, lead generation, CAC | Measures overall business impact and ROI |

Engagement Metrics | Time on site, email open/click rates, shareability | Highlights how well content resonates with the target audience [3][6] |

Technical SEO | Core Web Vitals, schema markup, metadata optimization | Ensures content remains discoverable and technically sound [2] |

Content marketing continues to outperform traditional advertising in cost-efficiency, generating three times as many leads while costing 62% less [21]. B2B companies leveraging consistent, SEO-driven content strategies see an average ROI of 748% [21]. Additionally, visitors arriving through AI-powered search tools convert at 4.4 times the rate of traditional organic traffic [21]. These benchmarks offer clear targets for financial services teams to aim for.

Using Data to Improve Content Strategies

Once you’ve identified the right metrics, the next step is using that data to refine your editorial strategy. Pairing analytics with AI-powered production tools creates a cohesive approach to improving content performance. A content scorecard with both qualitative and quantitative criteria can help prioritize projects that promise the highest ROI while filtering out those that don’t align with your goals [3].

Marketing Mix Modeling (MMM) is another powerful tool for optimizing budget allocation. Leaders who embrace MMM are more than twice as likely to exceed revenue goals by 10% or more [19]. Kamal Janardhan, Senior Director of Product Management at Google, underscores the importance of precision:

"Knowing how much budget to allocate to digital marketing is good; knowing the exact dollar amount that should go to Search, Display, or YouTube is better; and understanding how much spend should go to specific formats is best for actionable decision-making." [19]

First-party data is another game-changer. Marketers who use it to power AI reporting see a 30% performance boost compared to those who don’t [19]. For example, advertisers linking first-party data to offline conversions through enhanced tools achieve 8% more conversions than those relying on standard methods [19].

To stay ahead, establish feedback loops that bring performance data from published content back into the planning phase. Competitive analysis tools can also provide valuable insights into what competitors are doing - whether it’s content formats, trending topics, or tone - helping you identify opportunities to stand out [1]. Additionally, forming a content council that includes subject matter experts, sales teams, and product managers can uncover audience insights that raw data might miss, such as emerging customer pain points [3].

Case Study: Successful Editorial-Led Campaigns in Financial Services

Prudential Financial faced a familiar challenge: meeting growing content demands while maintaining brand consistency across its various business lines. By adopting Adobe Express for self-service content creation, Prudential enabled teams to produce assets faster while staying aligned with brand guidelines. The results? A 365% year-over-year increase in engagement [15].

The broader financial services industry shows even greater potential. For example, a $30 billion financial services firm can unlock over $108 million in annual value through content transformation - $84 million from productivity improvements and $24 million from increased revenue [15]. Companies that integrate AI into their content creation processes see a 5x net ROI over three years [15].

Streamlining the Medical, Legal, and Regulatory (MLR) review process is another area ripe for improvement. Financial services companies that use workflow management to connect creative, legal, and compliance teams early in the process can cut compliance failure rates by up to 80% [15]. This approach not only accelerates time-to-market but also reduces risk-related costs, which often act as hidden drains on ROI [6][20].

Combining AI speed with human oversight is proving to be a winning formula. Content produced through a hybrid model - AI drafting paired with human refinement - achieves 40% higher output and garners 5.44 times more traffic than content generated solely by AI [21]. As Rand Fishkin aptly puts it:

"AI-generated content is the new floor. Anyone can make it. Most of it is at least OK. Some of it's pretty good. If your content isn't better than what AI can produce, it's not worth making." [2]

For financial services, this underscores the need to invest in systems that automate tasks like research, drafting, and technical SEO, while keeping humans in charge of brand voice, compliance, and strategic direction. These results demonstrate the value of a balanced approach, setting the stage for even greater optimization in content strategies.

Conclusion: Growing Financial Services with Editorial-Led Strategies

Expanding financial services through editorial-led strategies isn’t about churning out more content. It’s about combining the speed and precision of AI with the strategic depth and insight of human expertise. This approach builds credibility, fosters trust, and delivers measurable outcomes. As highlighted earlier, financial firms embracing this model are already seeing clear results. While AI efficiently handles repetitive tasks, human professionals bring the strategic oversight and nuanced understanding essential in a highly regulated industry.

The momentum is undeniable. Recent data points to a surge in AI adoption among financial leaders. For example, Vanguard boosted its LinkedIn ad conversion rates by 15% using AI-powered personalization tools [4]. These early wins underline how treating editorial strategy as a foundational part of operations can lead to long-term, compounding rewards.

Sam Altman captures this shift perfectly:

"AI will handle 95% of traditional marketing work within five years. Strategic thinking, creative direction, and brand voice will remain the core differentiators for human marketers" [2].

The key lies in adopting a workflow where AI takes on research, drafting, and technical execution, while humans ensure alignment with strategy, compliance, and brand identity.

To sustain growth in this evolving landscape, companies must commit to three critical areas:

Governance frameworks: Integrate compliance checks early in the process to avoid missteps.

Feedback mechanisms: Create loops that enable continuous refinement and improvement.

Integrated tools: Invest in systems that unify strategy, execution, and analytics for seamless operations.

These strategic commitments will position financial services firms for enduring success in a rapidly changing market.

FAQs

How can AI tools ensure fast yet compliant content creation for financial services?

AI-powered content platforms are transforming how financial marketers create content, offering speed without sacrificing compliance. These tools integrate compliance checks directly into the content creation process, relying on pre-approved terminology, disclosure templates, and rules tailored to specific jurisdictions. Automated scans run in real-time, flagging any factual inaccuracies or potentially risky language before the content reaches human reviewers.

Take Averi AI, for instance. This platform blends the efficiency of generative AI with rigorous approval workflows. It flags compliance issues and ensures all content passes through a human review - often by a compliance officer - before being finalized. Beyond that, these systems maintain detailed audit trails, enforce data retention policies, and safeguard sensitive information. By automating repetitive tasks while keeping a structured oversight process in place, financial firms can produce content at scale while staying accurate, compliant, and aligned with their brand values.

What are the most important metrics to measure the success of editorial-led growth in financial services?

To gauge the success of editorial-led growth in financial services, it's crucial to monitor metrics that highlight both the effectiveness of your content and its impact on business outcomes. These include:

Conversion rate: This measures how well your content encourages readers to take key actions, like signing up for a service or making a purchase.

Customer acquisition cost (CAC): Tracks how much you're spending to gain each new customer through your content efforts, offering insights into cost efficiency.

Return on ad spend (ROAS): Evaluates the profitability of any paid promotions tied to your content, helping you understand if your investments are paying off.

Audience engagement: Metrics such as time spent on a page, social shares, and comments reveal how effectively your content connects with and engages your audience.

Lead quality: Goes beyond quantity to assess whether your content is attracting leads that are likely to convert into loyal, high-value customers.

Customer lifetime value (CLV): Measures the long-term revenue generated from customers acquired through your content, offering a broader view of its financial impact.

By keeping a close eye on these metrics, you can evaluate how well your editorial strategy is working and make informed adjustments to drive meaningful, sustained growth.

How can financial services create compliant content without limiting creativity?

Financial services can successfully merge compliance with creativity by embedding regulatory considerations directly into the content creation process, rather than addressing them as last-minute hurdles. A strong starting point is developing a comprehensive style guide that clearly outlines key regulatory requirements - such as those from the SEC or FINRA - and specifies rules for language, disclosures, and claims. Leveraging AI-powered tools like Averi AI during brainstorming sessions can help flag potential compliance issues early, enabling swift adjustments without derailing timelines.

Collaboration plays a pivotal role as well. Short, regular meetings between compliance and marketing teams can simplify the approval process, fostering a dynamic partnership rather than a rigid oversight dynamic. Platforms like Ziflow can further enhance this workflow by automating draft reviews, tracking changes, and ensuring deadlines are met - all without stifling creative momentum.

Equally important is ongoing investment in training and technology. Keeping teams up-to-date with the latest regulations and utilizing AI tools to scan for prohibited terms, enforce brand guidelines, and maintain audit trails ensures campaigns can be bold, personalized, and timely - while staying firmly within compliance boundaries.