Dec 11, 2025

How Sentiment Analysis Tracks Competitor Reviews

Averi Academy

Averi Team

8 minutes

In This Article

Use LLM-driven sentiment analysis on competitor reviews to reveal weaknesses, feature gaps, and trends, then turn insights into marketing and product actions.

Updated:

Dec 11, 2025

Don’t Feed the Algorithm

The algorithm never sleeps, but you don’t have to feed it — Join our weekly newsletter for real insights on AI, human creativity & marketing execution.

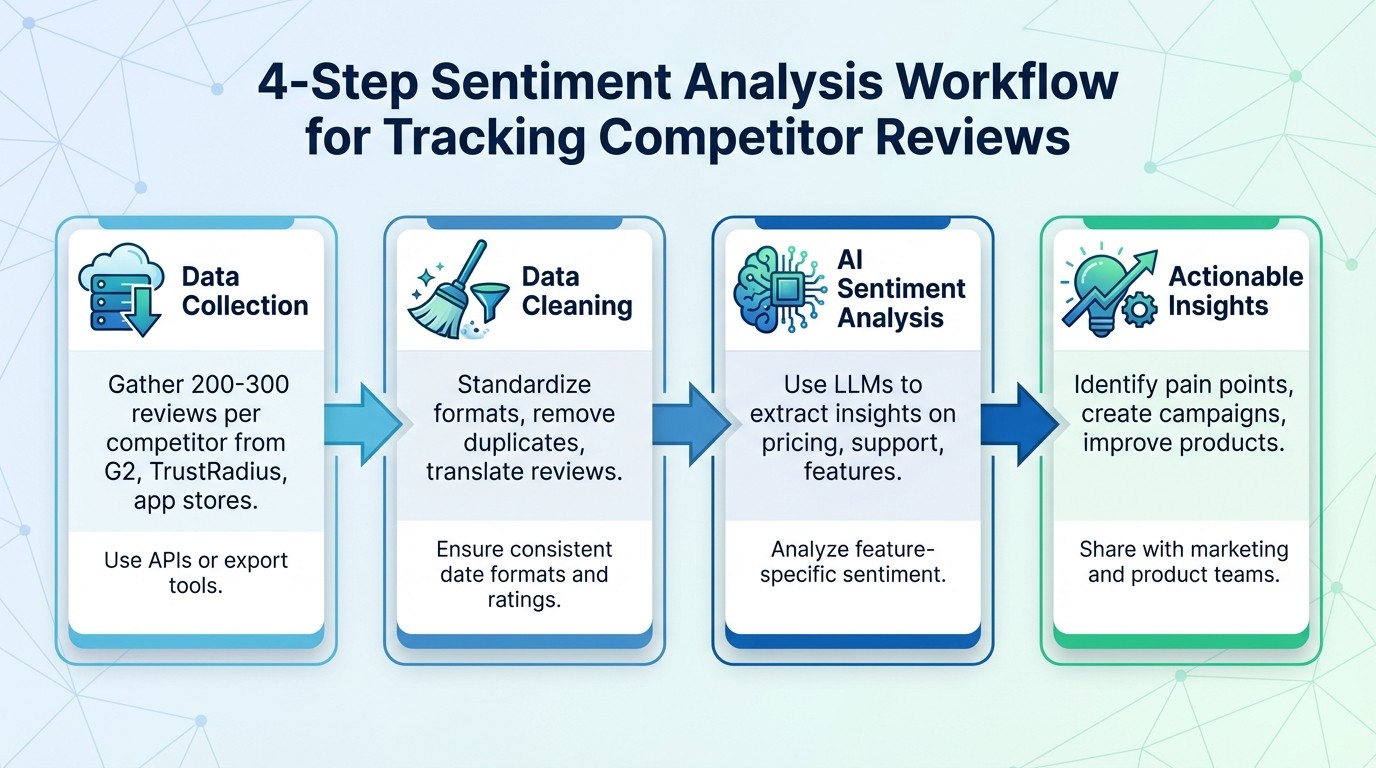

Sentiment analysis is a powerful tool that helps businesses understand how customers feel about their competitors' products or services. By analyzing reviews, companies can pinpoint competitor weaknesses, identify market gaps, and refine their strategies based on real customer feedback. Here's how it works:

Data Collection: Gather reviews from platforms like G2, TrustRadius, or app stores. Use APIs or export tools to ensure a robust dataset (200–300 reviews per competitor).

Data Cleaning: Standardize formats (e.g., dates, ratings), remove duplicates, and translate non-English reviews if necessary.

Sentiment Analysis with AI: Use large language models (LLMs) to extract detailed insights, such as customer sentiment on specific features like pricing or support.

Actionable Insights: Turn analysis into strategies by identifying pain points, creating marketing campaigns, and improving your product offerings.

This process isn’t just about understanding competitors - it’s about using that knowledge to make better decisions and stay ahead in the market.

4-Step Sentiment Analysis Process for Competitor Reviews

How to Analyze All Negative G2 Reviews of Your Competitors with ChatGPT

Setting Up Your Competitive Questions and Data Sources

Start by defining your objective. Focus on three key areas: features that are frequently praised or criticized, shifts in sentiment over time, and recurring weaknesses among competitors. This structure will guide your data collection and help you organize insights effectively.

Identify your data sources based on your industry. For B2B software, platforms like G2, Capterra, and TrustRadius are invaluable. Consumer apps, on the other hand, benefit from reviews on the Apple App Store and Google Play Store. To capture broader market sentiment, explore Reddit threads and X (formerly Twitter), which often feature raw, unfiltered opinions that traditional review sites might overlook. You can gather this data through APIs, manual exports, or compliant scraping tools.

Aim for a robust dataset - at least 200–300 reviews per competitor from the past 90 days. For seasonal businesses, extending the timeframe to six months may be necessary to identify trends. Your dataset should include essential details like review text, star ratings, posting dates, and, when possible, reviewer locations. While a few missing data points won’t derail your analysis, inconsistent date formats or improperly merged review text can create significant issues when segmenting by time or geography.

Always prioritize privacy compliance. Public reviews are fair game, but avoid scraping user profiles or accessing gated content without explicit permission. Such practices often breach platform policies and may violate regulations like GDPR or CCPA. Stick to publicly available review text and aggregate metadata to ensure your analysis remains ethical and within legal boundaries.

With your data in hand, the next step is cleaning and organizing it for a deeper analysis.

Collecting and Cleaning Competitor Review Data

Gathering Review Data

To analyze competitor reviews effectively, start by gathering data through export tools, APIs, or review aggregation services. Be sure to include essential metadata like the collection date and source, as this information helps track sentiment trends over time.

Cleaning and Standardizing the Data

Before diving into analysis, clean up your dataset. Eliminate duplicate entries to avoid skewed results. If reviews are in languages other than English, either exclude them or translate them if possible. Standardize star ratings across all sources to a consistent 1–5 scale. For financial data, convert all currencies to USD using the exchange rate applicable on the review date. Additionally, ensure all dates follow the MM/DD/YYYY format, and use decimal points for numerical data to maintain uniformity.

Structuring Data by Segments

Organize your data into meaningful segments, such as by competitor, product line, region, or time period (e.g., monthly or quarterly). This segmentation helps identify patterns or shifts in sentiment. Use AI-powered tools to manage and analyze these segments, consolidating them into a single, searchable database [1][2].

With your data cleaned, standardized, and segmented, it’s ready for sentiment analysis using large language models (LLMs), which can uncover actionable insights for your strategy.

Running LLM-Based Sentiment Analysis

Once you've organized your competitor review data, using large language models (LLMs) for sentiment analysis can help uncover deeper, actionable insights.

Choosing the Right Sentiment Analysis Method

While basic tools provide simple "positive" or "negative" sentiment labels, LLMs go further by capturing the subtleties of customer feedback. They can highlight specific emotions tied to elements like pricing, customer support, or interface design. For instance, where a generic tool might flag a review as "negative", an LLM can pinpoint whether the frustration stems from high costs or poor usability. Custom prompts allow you to dive into these details with precision.

Platforms like Averi AI offer tailored solutions by combining proprietary data with human expertise. As Payton from Broadside shared:

"I've been testing it against ChatGPT…I love how it's customized to the information that I have in there in terms of my brand and tone" [1].

The next step is to segment this data into feature-specific sentiments for a clearer understanding of customer feedback.

Breaking Down Sentiment by Feature

LLMs excel at analyzing reviews by specific features. By crafting targeted prompts, you can identify sentiment for aspects like pricing, customer support, or ease of use - whatever matters most to your analysis. For instance, you might use a prompt like: "Extract sentiment for pricing, support quality, and user interface from this review. Return results as JSON with feature name, sentiment score (1-5), and a supporting quote."

This method transforms unstructured feedback into structured, actionable data points that can be easily visualized in dashboards or shared with your team.

Centralizing Analysis with AI Workspaces

Once you've extracted detailed sentiment data, managing it effectively is key. AI workspaces can help you consolidate and organize everything in one place. Platforms like Averi AI allow you to store prompts, outputs, and context together, while also training the AI to align with your brand's unique needs.

Indy from Lucid AI highlighted the benefits of such an approach:

"We replaced five disconnected tools with Averi and got 40% faster execution with 25% performance improvement" [1].

Turning Sentiment Data into Marketing and Product Actions

Once you've segmented and analyzed your sentiment data, the real challenge begins: transforming those insights into meaningful actions. While the earlier steps focused on breaking down sentiment data, this phase is all about execution. By leveraging the insights from competitor reviews, you can move from understanding to action. Many teams face difficulties bridging this gap, but AI marketing tools can simplify the process.

Creating Dashboards to Track Sentiment Trends

Visual dashboards are invaluable for monitoring shifts in sentiment over time. These tools allow you to track key metrics like average sentiment scores, mention volumes, and competitor comparisons all in one place. For example, if competitor reviews reveal a steady decline in sentiment around their customer support, it’s an opportunity to emphasize your own strong support in marketing campaigns. Dashboards like these make it easier to identify and act on emerging patterns.

Finding Feature Gaps and Customer Pain Points

By ranking features based on sentiment data, you can uncover areas where competitors fall short. These insights can guide your messaging to highlight strengths that align with customer needs, turning competitor weaknesses into your advantage.

Sharing Insights with Marketing and Product Teams

Data is only as impactful as the actions it inspires. Ensure insights are shared in actionable formats with marketing, product, and sales teams. Tools like Averi AI streamline this process, making it easier to turn data into campaigns. As Laura from Cove & Current noted:

"Averi cut through the noise and gave us what we actually needed... a clear path from insight to campaign. No more guessing, no more wasted effort." [1]

Conclusion

Analyzing competitor reviews goes beyond identifying weak spots like poor customer support, missing features, or confusing pricing. It’s about transforming that feedback into insights that drive smarter positioning and sharper campaigns. This process takes raw review data and turns it into actionable strategies that both marketing and product teams can leverage effectively.

The real hurdle isn’t gathering the data or running the analysis - it’s bridging the gap between discovery and action. Too often, teams uncover valuable insights but struggle to translate them into actual campaigns. This is where an AI marketing workspace can make all the difference, turning insights into execution.

Platforms like Averi AI simplify this transition by bringing together data analysis, content creation, and team collaboration in a single workspace. As David from Thorn shared:

"Averi doesn't just give us insights, it helps us act on them. That's the gap every other platform misses. We're finally turning data into real campaigns." [1]

The ability to act quickly and consistently creates a lasting edge. By establishing a system to analyze competitor sentiment and convert it into marketing initiatives, you’re not just solving immediate challenges - you’re building a process that becomes more efficient and impactful over time. Each analysis sharpens, and each campaign launch becomes smoother.

Start by focusing on a single competitor and one review source. Use this as a pilot to test and refine your approach. Once you’ve launched your first campaign, systematize the process to ensure ongoing success and scalability.

FAQs

How does sentiment analysis uncover competitor weaknesses?

Sentiment analysis offers businesses a way to identify weaknesses in their competitors by examining customer reviews for repeated negative comments. This approach pinpoints common frustrations, unmet expectations, and missing features in competitors' products or services.

Armed with these insights, companies can fine-tune their own offerings to directly address these gaps, positioning themselves more effectively in the marketplace.

What are the best tools for analyzing competitor reviews?

AI-powered platforms such as Averi AI and Copy.ai are incredibly useful for diving into competitor reviews. These tools help analyze sentiment trends, spot feature gaps, and identify customer pain points, giving you the insights needed to fine-tune your marketing approach and overall strategy.

Averi AI stands out with its marketing-focused AI capabilities, offering advanced research and strategic insights. It’s a valuable resource for marketers aiming to maintain a competitive edge in today’s fast-paced landscape.

How do large language models improve sentiment analysis for competitor reviews?

Large language models take sentiment analysis to a new level by interpreting customer feedback with greater depth and precision. They excel at picking up on subtle emotional cues, tracking sentiment shifts over time, and spotting recurring patterns such as missing features or common frustrations. This enables businesses to gain richer insights into competitor reviews and identify areas where they can refine their own products or services.