Dec 23, 2025

How to Create AI-Assisted Content Workflows for Financial Services

Averi Academy

Averi Team

8 minutes

In This Article

Guide to designing and scaling AI-assisted content workflows in financial services, speeding production while enforcing compliance and human approval.

Updated:

Dec 23, 2025

Don’t Feed the Algorithm

The algorithm never sleeps, but you don’t have to feed it — Join our weekly newsletter for real insights on AI, human creativity & marketing execution.

Creating content for financial services is challenging. With strict regulations, sensitive data, and the need for high-quality output, traditional workflows often feel slow and inefficient. AI-assisted processes can solve this by automating repetitive tasks, speeding up compliance checks, and ensuring consistency - all while keeping human oversight intact.

Key Takeaways:

AI improves efficiency: Teams using AI workflows reduce content creation time from hours to minutes.

Compliance is built-in: AI can flag regulatory risks, monitor language, and maintain audit trails.

Structured workflows matter: Dividing tasks into clear phases (e.g., planning, drafting, compliance review) ensures smooth collaboration between AI and humans.

Real results: Firms like Chime and HSBC report faster processes, reduced errors, and improved engagement metrics.

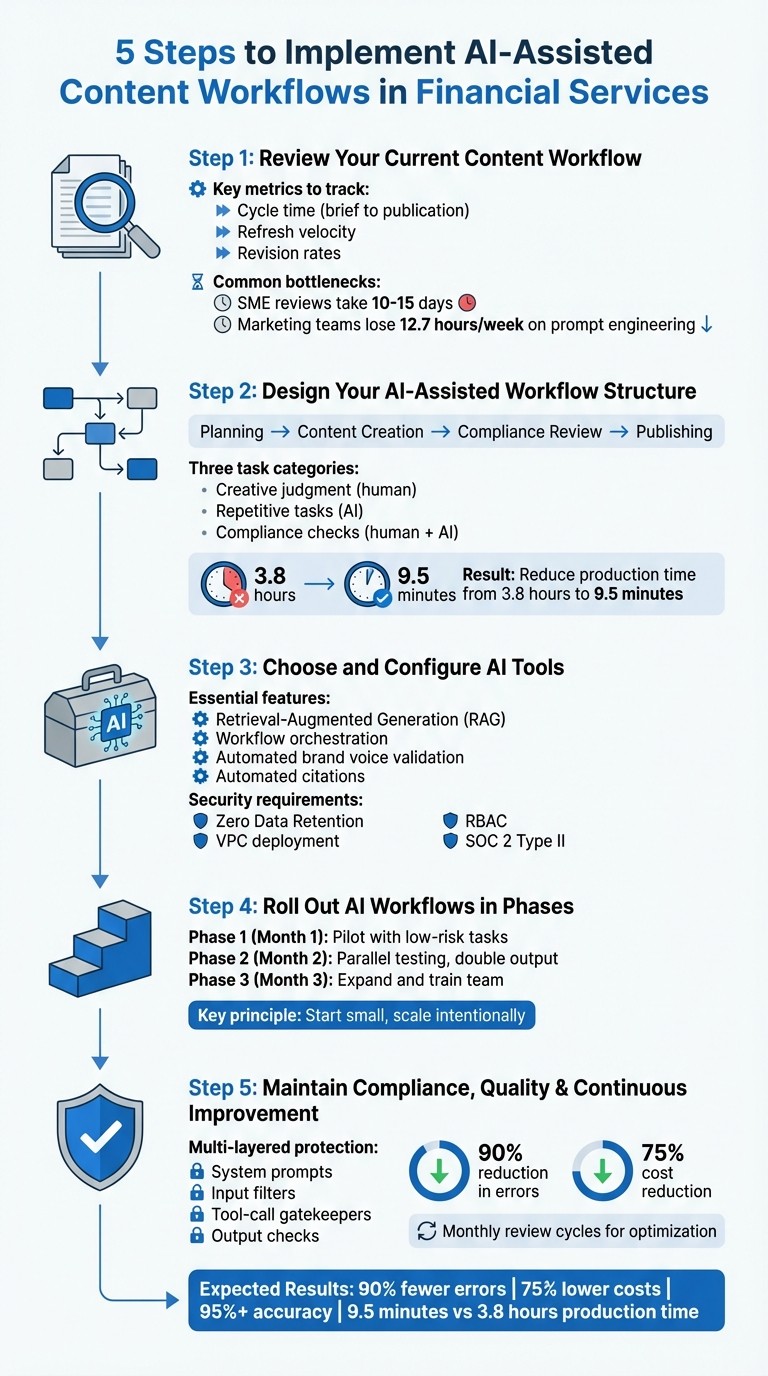

This guide outlines five steps to implement AI-assisted workflows, from reviewing current processes to rolling out changes gradually. Whether you're at a bank or a fintech startup, these strategies will help you save time, maintain compliance, and deliver better content.

5-Step AI Content Workflow Implementation for Financial Services

Integrating AI Tools Across Financial Workflows

Step 1: Review Your Current Content Workflow

Before introducing AI into your processes, it’s essential to figure out where your team is losing time and pinpoint the bottlenecks. In financial services, inefficiencies often surface during subject matter expert (SME) reviews, which can stretch out to 10–15 days and require multiple follow-ups [3]. Marketing teams also spend an average of 12.7 hours per week wrestling with "prompt engineering gymnastics", constantly tweaking AI prompts to fix inconsistent outputs [4].

To start, map out every step of your content creation process - from the initial brief to the final publication. Assign each step to one of three categories: creative judgment (tasks requiring human expertise and strategic thinking), repetitive transformation (tasks like formatting or adapting content for various platforms), or compliance check (regulatory reviews and legal approvals) [7]. This breakdown helps identify which tasks are ripe for automation, with repetitive transformations often delivering the quickest efficiency gains.

Map Your Current Processes and Identify Bottlenecks

Take a close look at every handoff, approval stage, and delay in your workflow. SME reviews are frequently the biggest bottleneck [3]. To speed things up, consider shifting to the "Reporter Model": instead of asking SMEs to draft content, treat them as sources. Conduct short, focused interviews - about 15 minutes - to extract their expertise, then let your content team handle the writing [3]. This approach preserves accuracy while slashing time delays.

Additionally, document key resources your team relies on, such as style guides, brand assets, regulatory documents, and compliance templates. These materials are critical for AI tools to produce accurate results and avoid errors like "hallucinations" [7]. By cataloging these resources, you ensure AI systems have the context they need to perform effectively. Identifying these bottlenecks and gaps is the first step toward integrating AI where it can make the most impact.

Track Key Performance Metrics

Set baseline metrics to measure how AI improves your workflow. Focus on tracking:

Cycle time: How long it takes to go from brief to publication.

Refresh velocity: The speed at which you update existing content.

Revision rates: How often drafts need rework.

These metrics provide a clear picture of your current efficiency. For example, one firm reduced its content refresh time from 45 minutes to under 5 minutes by adopting AI workflows [2]. Establishing these baselines will help you quantify similar gains.

For financial services, it’s also critical to monitor compliance incidents and maintain an audit trail. Keep detailed records of who approved each piece, which version of the style guide was used, and what prompts were applied. This kind of documentation isn’t optional - it’s a regulatory must [4].

Review Your Existing Tools and Integrations

Evaluate your CMS, CRM, compliance software, and AI tools to identify where manual processes or integration gaps slow things down. Pay attention to areas where data doesn’t flow seamlessly between platforms or where team members are forced to copy and paste information.

Ensure your current tools meet the stringent audit trail and version control demands of financial services regulations. Relying on ad-hoc AI prompts without proper documentation can lead to what experts call a "compliance nightmare" [4].

"Ad-hoc prompts don't scale. They're brittle, inconsistent, and create zero institutional knowledge."

Step 2: Design Your AI-Assisted Workflow Structure

After mapping your existing processes, the next step is to develop a workflow that integrates AI while adhering to compliance standards in financial services. The aim here is to establish a modular framework that divides content production into distinct phases - like Ingest (data collection), Brief (strategic planning), Draft (content creation), QA (quality assurance), and Publish (distribution). This setup ensures seamless collaboration between AI automation and human oversight, maintaining compliance throughout [4].

Define Workflow Phases and AI's Role

Start by organizing your workflow into key phases such as Planning, Content Creation, Compliance Review, and Publishing. Within each phase, pinpoint tasks that fall into one of three categories: those requiring creative judgment (where human expertise is essential), repetitive tasks (like formatting or adapting content for different platforms), and compliance checks (ensuring regulatory and legal standards are met) [7].

AI thrives in handling repetitive tasks. For instance, multiple prompts can be used to optimize outputs: one for headlines, another for data-driven sections, and another for fact-checking [4]. This approach significantly cuts production time - from 3.8 hours to just 9.5 minutes [4]. AI can also pull data from internal knowledge bases using Retrieval-Augmented Generation (RAG), draft initial content, and create platform-specific variations. Meanwhile, human contributors refine the drafts, add specific examples, and ensure the content aligns with the brand’s voice [4] [3].

Workflow Phase | AI Integration Opportunity | Human Role |

|---|---|---|

Planning/Strategy | Audience research, keyword analysis, and trend identification [1] | Defining business objectives and overall strategy [3] |

Preparation (Ingest) | Extracting data from internal knowledge bases via RAG [4] | Curating and updating the knowledge base [4] |

Creation (Drafting) | Generating outlines, first drafts, and platform variations [1] | Adding nuance, examples, and the brand's personality [3] |

Publishing | Metadata generation, social scheduling, and CMS formatting [4] | Conducting a final technical review [3] |

Once these phases are mapped out, include specific checkpoints for human oversight to ensure compliance and quality.

Build Human Review and Compliance Checkpoints

In financial services, integrating human oversight is a regulatory requirement, not a choice. Establish manual approval stages for high-risk content [7] [4]. For example, route sensitive or compliance-critical content to subject matter experts for review [4].

Use the "Reporter Model" as a practical approach: interview experts to gather information, then let your AI-assisted team draft the content [3]. Additionally, implement automated tools that validate style and tone, flagging issues like passive voice or jargon in real time based on your organization’s style guide [4].

"True transformation comes from orchestration: intelligent systems that operate across the full pipeline."

Establish Data Governance and Security Protocols

To complement your existing audit practices [4], extend data governance measures to cover every AI action within your workflow. This ensures that sensitive data remains protected and that all processes are auditable.

Financial services demand robust safeguards. Use system prompts to enforce behavioral rules (e.g., "Always cite sources from the approved whitelist"), input filters to block irrelevant or harmful queries, and output checks to catch restricted terms like "CONFIDENTIAL" [6]. Additionally, implement gatekeepers to limit AI actions, such as restricting trades to under 5% of a portfolio [6].

Maintain a thorough audit trail for every AI interaction, documenting prompts used, style guides referenced, and approvals given. Such measures have led to a 90% reduction in error rates and a 75% cut in production costs for companies adopting structured workflows [4].

"Because finance is a tightly regulated, high-stakes domain, workflow-style automations, which offer more control and predictability, are more likely to be adopted in practice than highly autonomous, low predictability agents."

Brian Pisaneschi, CFA, CFA Institute[6]

Step 3: Choose and Configure AI Tools

After outlining your workflow structure, the next critical step is selecting the most suitable AI platform. For financial services, this means deciding between tools designed for specific tasks and integrated systems that handle the entire content pipeline. This decision has a direct impact on compliance, efficiency, and the time saved on re-prompting AI tools.

Features to Look for in AI Platforms

When evaluating AI platforms, prioritize Retrieval-Augmented Generation (RAG). This feature ensures AI outputs are grounded in your proprietary data - such as product specifications, case studies, and other internal knowledge bases [4]. Additionally, look for platforms with workflow orchestration to manage the full pipeline (from ingestion to publishing), automated brand voice validation to enforce your tone and terminology in real time, and automated citations to create the audit trails regulators require [4].

Teams that use structured workflows with these features report drastically reduced production times, achieving publication-ready articles in just 9.5 minutes compared to the manual average of 3.8 hours [4].

Point Solutions vs. Integrated Workspaces

Point solutions, like Jasper or ChatGPT, are ideal for handling specific tasks, such as drafting social media posts or checking grammar. These tools are easy to adopt and work well for individuals. However, they often lead to context-switching fatigue. Marketing teams lose an average of 12.7 hours per week re-prompting tools and manually transferring data between platforms. Each interaction starts from scratch, with no memory of past campaigns or adherence to brand guidelines [4].

In contrast, integrated workspaces, such as Averi AI, provide continuous project context across campaigns. These platforms allow experts to jump into workflows with full visibility of strategic goals, eliminating the need for constant re-briefing. They also enforce brand voice automatically, include built-in governance, and maintain audit trails essential for regulatory compliance. While initial setup may take more time, these systems can cut production costs by up to 75% [4]. For financial services, where compliance mistakes can have serious consequences, the structured approach of orchestration hubs offers greater reliability and control than point solutions.

Once you've chosen your platform, the next step is configuring it to meet the stringent compliance and data governance standards required in financial services.

Configuring AI for Financial Services

After selecting a platform, fine-tune it to ensure secure operations and strict data governance. Start by enabling Zero Data Retention (ZDR) policies to prevent your AI vendor from storing or training models on sensitive financial data. Deploy within a Virtual Private Cloud (VPC) or on-premise environment to maintain full ownership of your data [8][10][11]. Use RBAC (Role-Based Access Control) to align with your enterprise's existing permissions and block unauthorized access [11]. Before moving forward, confirm that your vendor meets certifications such as SOC 2 Type II, ISO 27001, or compliance with GDPR/CCPA [8][12].

Additionally, set up automated compliance monitoring. Use specialized agents to cross-check financial statements against IFRS or GAAP standards, flagging missing disclosures. Ensure your tools provide step-by-step reasoning and comprehensive source citations for every output, creating an audit-ready trail [8][9].

By 2026, it's anticipated that 90% of finance teams will have implemented at least one AI-powered solution, with 83% expecting widespread AI usage in financial reporting within the next three years [9][12].

"AI isn't optional anymore for Finance and FinServ teams."

Step 4: Roll Out AI Workflows in Phases

Once your platform is set up, it’s time to implement AI workflows step by step. Taking a phased approach helps minimize risks, pinpoint potential challenges early on, and allows your team to gradually adapt. Jumping straight into full-scale deployment can lead to compliance issues and pushback from your team, so think of this as a three-month rollout, starting small and scaling up intentionally.

Phase 1: Start with Pilot Programs

Begin by targeting high-volume, low-risk tasks like writing social media posts, drafting emails, summarizing industry trends, or creating educational materials. These tasks are repetitive and time-consuming but don’t usually require heavy input from subject matter experts (SMEs) [3]. Starting here ensures you can achieve quick wins while keeping risk low.

Focus on processes that are straightforward and repetitive - the easy wins that deliver the fastest returns. For instance, if your team spends hours reformatting quarterly reports into client-ready summaries, this would be a perfect candidate for an AI pilot program.

Dedicate the first month to training and setting up tools [3]. Clearly outline rules for the pilot phase, such as prohibiting AI from inventing data, fabricating testimonials, or providing unreviewed advice in regulated industries [5]. These guidelines help your team avoid costly mistakes and establish clear boundaries from the start.

Phase 2: Run Parallel Testing

For two weeks, conduct parallel tests by producing 10–15 pieces of content with AI while continuing your usual processes. Use this phase to measure metrics like time-to-completion, quality scores, and team feedback [4]. This side-by-side comparison will help you assess AI’s accuracy and refine its settings before rolling it out more broadly.

Introduce human-in-the-loop (HITL) gates at critical stages. For example, an AI draft could first go to an editor, then to legal or brand teams for review on high-risk pieces [6][7]. In industries like financial services, avoid giving AI full autonomy for sensitive tasks like compliance reviews or proposal writing. Instead, rely on structured workflows - predefined paths that ensure predictability and control, which are crucial for meeting regulatory expectations [6].

To address the SME bottleneck, consider a more efficient approach: have marketing teams draft content and ask SMEs to verify it rather than creating it from scratch [3]. This method saves time and allows experts to stay focused on their primary responsibilities.

In Month 2, aim to double your current manual output instead of attempting a dramatic increase [3]. Scaling gradually prevents overwhelming your review team and provides time to identify and address potential issues. Additionally, require writers to verify any URLs or citations suggested by AI to ensure the content remains accurate [5].

These steps will set the foundation for a smooth transition to full-scale deployment.

Phase 3: Expand and Train Your Team

Once the pilot proves successful, extend AI workflows to other departments and provide training on how to monitor and manage AI performance. Create an AI ethics board with members from Marketing, IT, and Compliance to ensure alignment with regulations like CCPA and GDPR [3].

Incorporate automated validators to check style and tone in real time, ensuring content aligns with your brand guidelines before it reaches human reviewers [3]. Maintain audit trails for every AI-generated piece, documenting the prompt, data sources, and final approval [3]. This level of documentation is critical for regulatory compliance and internal accountability.

As you scale, focus on maintaining human expertise. Over-reliance on AI can hinder critical thinking, especially for junior staff. Provide opportunities for them to develop core skills alongside automated tasks [3]. For heavily regulated content, consider hiring specialist freelancers as SME reviewers to avoid overburdening your in-house experts [3].

"Rather than asking AI to hurl itself over the abyss, we should use AI's capabilities to build bridges." - Agentix Labs [7]

Step 5: Maintain Compliance, Quality, and Continuous Improvement

As content production scales, keeping up with regulatory compliance, ensuring consistent quality, and refining processes are non-negotiable. This stage hinges on systematic monitoring, well-structured feedback loops, and thorough documentation that satisfies both internal teams and external auditors.

Monitor Compliance and Maintain Audit Trails

Regulatory standards require detailed documentation for every piece of content. This means tracking AI interactions, approvals, sources, and revisions to support potential audits [4].

To safeguard compliance, create a multi-layered protection system that works at every stage of content creation. Start with system prompts defining core rules, such as "Always cite a source for every financial metric provided." Use input filters to block requests that violate policies, like asking AI for unauthorized investment advice. Introduce tool-call gatekeepers to limit AI access to sensitive data or prevent actions beyond defined parameters. Finally, apply output checks to flag restricted terms, unverifiable claims, or language that could raise regulatory concerns [6].

"Because finance is a tightly regulated, high-stakes domain, workflow-style automations, which offer more control and predictability, are more likely to be adopted in practice than highly autonomous, low predictability agents." - Brian Pisaneschi, CFA [6]

For content involving financial decisions, risk assessments, or sensitive client data, incorporate a human-in-the-loop (HITL) process. This ensures a qualified professional reviews and approves content before publication [6][3]. Document these approvals with timestamps, reviewer credentials, and any changes made during the review process.

Leverage Retrieval-Augmented Generation (RAG) to ground AI outputs in verified internal data, such as compliance manuals, approved product specifications, and regulatory guidelines. This minimizes inaccuracies and ensures alignment with current policies [6][4]. Conduct monthly source audits to ensure your AI’s knowledge base reflects the latest financial data and regulatory updates [4][1].

Once compliance is under control, the focus shifts to maintaining high content quality.

Implement Quality Control Checks

Ensuring quality in AI-assisted workflows requires a mix of automated tools and human oversight. Use real-time style and tone validators tailored to your brand voice and regulatory requirements. These tools can flag issues like passive voice, prohibited jargon, or unverifiable claims before content reaches human reviewers [4].

Set clear accuracy thresholds and implement a multi-step verification process. AI-generated claims should include citations, undergo automated checks against a whitelist of trusted sources, and receive final verification from humans for high-stakes content [5][4]. This layered approach can push factual accuracy above 95%, compared to the 70-80% accuracy of unchecked AI outputs [4].

Introduce review gates at critical stages of production [3][5][4]. For technical or regulated content, route drafts to subject matter experts - like financial analysts, compliance officers, or legal teams - who can verify details beyond the AI’s capabilities [3][5][4].

To avoid overburdening experts, consider the "reporter model." Instead of asking experts to write or review full drafts, have your team conduct short interviews to gather insights. Use these interviews as the foundation for AI-generated content, ensuring accuracy while respecting the experts’ time [3].

With compliance and quality checks in place, the final piece is ongoing improvement.

Create Feedback Loops for Optimization

Continuous improvement is the backbone of a successful workflow. Implement structured feedback mechanisms that help refine processes over time. One effective strategy is an evaluator-optimizer loop, where one AI model generates content and another critiques it against quality standards. This iterative process resolves issues before the content reaches human reviewers [6].

Track performance metrics to identify areas for refinement. Companies using structured AI workflows report a 90% reduction in production errors and a 90% improvement in brand voice consistency [4]. Monitor production timelines, revision cycles, and bottlenecks to adjust prompts, review stages, and workflows as needed.

Start with low-risk content to build trust in your processes before scaling to more sensitive materials, like regulatory content or client-facing proposals [3]. This phased approach allows you to identify and address friction points while ensuring your team remains focused on high-value tasks and strategic decision-making [7].

Schedule monthly review cycles to gather feedback and update system prompts [4][1]. Pay attention to recurring edits, common team questions, and the types of content that resonate most with your audience. These insights will help refine your workflows and keep your content strategy aligned with both internal goals and external expectations.

Conclusion: Building Scalable and Compliant AI Workflows

AI-driven content workflows in financial services strike a balance between the speed of automation and the reliability of human oversight. By following the strategies outlined in this guide, organizations can scale their operations without compromising on regulatory compliance or content quality.

Transitioning from ad-hoc AI prompting to structured workflows has proven to deliver tangible results. Teams leveraging these orchestrated systems report producing publication-ready content in just 9.5 minutes, a dramatic improvement over the manual average of 3.8 hours [4]. However, speed alone isn't enough - accuracy remains paramount. Grounding AI outputs with Retrieval-Augmented Generation (RAG), incorporating Human-in-the-Loop (HITL) review checkpoints, and automating compliance validations ensure that efficiency doesn't come at the expense of regulatory confidence [4][7][5].

"True transformation comes from orchestration: intelligent systems that operate across the full pipeline." - TVTechnology [7]

To fully realize these benefits, treat AI as one part of a cohesive workflow rather than a standalone solution. Begin by mapping your content lifecycle to pinpoint areas where AI can enhance efficiency and where human expertise is indispensable. Platforms like Averi AI integrate AI capabilities with human collaboration in a unified workspace, offering full audit trails and preserving brand context across projects. This eliminates fragmented communication and data silos, creating a seamless process from start to finish.

FAQs

How does AI help ensure compliance when creating financial content?

AI has become an essential tool for ensuring compliance by actively monitoring and enforcing regulatory standards throughout the content creation process. Advanced AI platforms can automatically track updates from regulatory authorities like the SEC, FINRA, CCPA, or GDPR, aligning these rules with your organization’s internal policies. This means writers receive instant alerts if their content includes language that doesn’t meet compliance standards or omits necessary disclosures.

When integrated into content workflows - such as through AI-powered tools like Averi - AI performs automated checks for regulatory language, brand voice alignment, and adherence to data-retention guidelines before the content moves to approval stages. It can flag restricted terms, recommend compliant alternatives, and even apply pre-approved disclosure templates, minimizing errors while speeding up production timelines. With built-in approval processes, only content that fully complies with regulations gets published, creating a streamlined and scalable system that maintains both efficiency and creative integrity.

What are the essential steps to integrate AI into content workflows for financial services?

To weave AI into your content workflows effectively, begin by outlining your entire process - from brainstorming ideas to hitting "publish." Pinpoint repetitive tasks, such as conducting research, drafting content, or performing SEO checks, where AI can lend a hand. Once you've identified these areas, select AI tools that match your specific needs and integrate them seamlessly with your current systems, like your CMS or CRM.

While AI can handle execution, keep humans at the helm for critical decisions, compliance oversight, and final approvals. Start small by testing the revamped workflow on a limited scale, and monitor improvements in efficiency, accuracy, and adherence to guidelines. To wrap it up, put clear governance policies and monitoring systems in place to maintain consistency, scalability, and compliance as your organization grows.

How can AI-assisted workflows enhance efficiency in financial services?

AI-powered workflows are transforming how financial services teams handle content creation and compliance, making processes faster and more consistent. By automating tedious tasks like data extraction, SEO audits, formatting, and compliance tagging, these tools can shave nearly half the time off the journey from draft to publication. For larger projects, this can mean saving weeks on production timelines.

This automation frees up professionals to concentrate on more impactful work, such as strategic planning, understanding their audience, and ensuring regulatory standards are met. Meanwhile, AI actively maintains brand consistency and compliance throughout the process. Financial organizations leveraging these tools have reported notable benefits, including quicker content updates and fewer operational slowdowns. This allows them to efficiently produce high-quality, regulation-compliant content at scale.