Feb 14, 2026

How to Run Founder-Led Marketing for Financial Services

Averi Academy

Averi Team

8 minutes

In This Article

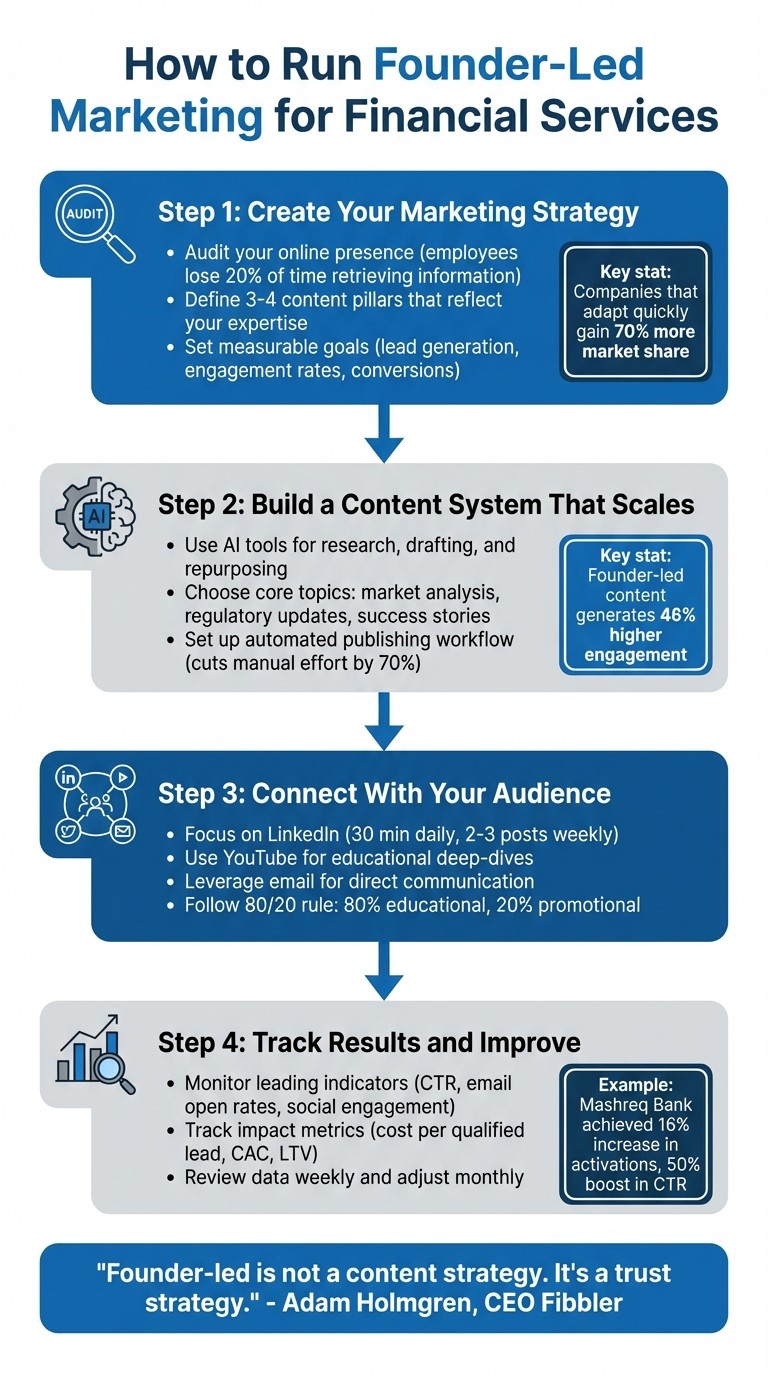

A practical guide to trust-driven, compliant founder-led marketing in financial services: audit your presence, set 3–4 content themes, use AI, and track lead metrics.

Updated:

Feb 14, 2026

Don’t Feed the Algorithm

The algorithm never sleeps, but you don’t have to feed it — Join our weekly newsletter for real insights on AI, human creativity & marketing execution.

Founder-led marketing is a powerful way to connect with your audience in financial services. By centering your expertise and personal vision, you can build trust, navigate strict regulations, and create meaningful engagement. Here's a quick summary of the approach:

Why It Matters: Financial services require trust and compliance. Founder-led marketing helps establish credibility and transparency, addressing customer skepticism.

Key Goals: Position yourself as an expert, build trust through clear communication, and drive sustainable growth without relying heavily on paid ads.

How to Start:

Audit your online presence for inefficiencies and compliance gaps.

Define what sets your brand apart with 3–4 content themes.

Set measurable goals tied to lead generation and engagement.

Content Strategy:

Use AI tools to streamline content creation while ensuring compliance.

Focus on topics like market trends, regulatory updates, and anonymized success stories.

Use AI content repurposing techniques to maximize reach across platforms.

Engagement Tactics: Prioritize LinkedIn for professional connections, use YouTube for in-depth educational videos, and leverage email for direct communication.

Tracking Results: Monitor metrics like click-through rates and cost per qualified lead. Use both quantitative data and customer feedback to refine your strategy.

This approach emphasizes consistency, transparency, and leveraging technology to amplify your voice while adhering to industry regulations. Start small, measure results, and adjust as needed to build trust and long-term connections.

4-Step Framework for Founder-Led Marketing in Financial Services

Step 1: Create Your Marketing Strategy

Review Your Current Online Presence

Start by evaluating where you currently stand online. Take a close look at your last three campaigns over the past 30 days to uncover inefficiencies and identify what’s delivering the most value. Research shows that employees often lose nearly 20% of their time just retrieving or recreating information[3].

Next, investigate whether data silos are slowing you down. For example, if your email, CRM, and social media platforms don’t communicate seamlessly, you’re not only wasting time but also risking compliance issues. In industries like financial services, maintaining clear audit trails is non-negotiable, and scattered data can make meeting regulatory requirements a headache.

Lastly, ensure your content aligns with SEC, FINRA, and GLBA regulations. Claims need to be verified, performance statements must include proper disclosures, and every piece of content should have a documented approval process. If you’re unable to quickly prove compliance with your current materials, addressing these gaps should move to the top of your to-do list.

Once you’ve mapped out your current position, shift your attention to what makes your brand stand out.

Clarify What Makes You Different

In financial services, standing out isn’t about flashy advertising - it’s about building trust. A founder’s personal vision often plays a key role in fostering that trust and driving growth.

"Founder-led is not a content strategy. It's a trust strategy." – Adam Holmgren, CEO and Co-founder, Fibbler[5]

Your unique value proposition should serve as the backbone of your compliance narrative and relationship-building efforts. Clients need to understand your mission and expertise before they even think about making a purchase. By sharing your perspective, the problems you solve, and even your challenges, you create a connection that polished corporate messaging simply can’t replicate.

Define 3–4 content pillars that reflect your expertise and align with your business goals. These recurring themes will help build consistency and recognition over time.

Set Clear Goals and Metrics

Swap out vague objectives for specific, measurable goals tied directly to your business outcomes. In financial services, focus on metrics that truly matter - like lead generation, engagement rates, and conversion tracking - rather than vanity metrics like follower counts.

Pay close attention to leading indicators, such as email click-through rates, engagement on professional networks, and time spent on critical webpages. Use a straightforward weekly dashboard to track these numbers so you can spot trends and make quick adjustments. Not only will clear metrics help you measure progress, but they’ll also enhance your credibility as a financial expert. Companies that adapt quickly to market shifts can gain up to 70% more market share than their slower-moving competitors[3].

Step 2: Build a Content System That Scales

Use AI Tools to Speed Up Content Production

One of the toughest hurdles in content creation is maintaining both quality and compliance. This is where AI tools come in handy - they can tackle research, drafting, and repurposing, allowing you to focus your energy on strategy and adding your expertise.

Start by using AI for research and outlining. For instance, tools like Averi AI can quickly pull the latest SEC updates or distill complex financial regulations into actionable summaries. With AI handling the first draft, you can then refine the content, adding your unique insights. This method not only slashes the time spent on content creation but also ensures your voice remains front and center.

Select AI tools that include compliance features designed for FINRA and SEC rules. These tools can flag sensitive areas - like investment advice - and help anonymize client success stories to avoid data privacy issues. What used to take hours of manual review can now be done in minutes, keeping production efficient without compromising on regulatory standards.

To further speed things up, implement parallel workflows. For example, while one piece of content is under compliance review, use AI to draft your next blog post or generate social media assets. This approach minimizes downtime and accelerates your time-to-market. Research shows that companies with faster time-to-market can capture up to 70% more market share than their slower competitors [3].

By integrating AI seamlessly into your process, you'll be ready to focus on selecting the right topics that resonate with your audience.

Choose Your Core Content Topics

Your content topics should align with your core themes and address your audience's needs. In financial services, some of the most effective topics include market analysis (e.g., how interest rates impact portfolios), regulatory updates (like changes to Dodd-Frank), and anonymized success stories that showcase your expertise. These types of content not only demonstrate your knowledge but also build trust with your audience.

Data shows that founder-led content focused on industry insights generates 46% higher engagement compared to standard corporate messaging [2]. For example, if you publish a case study about navigating 2025 cryptocurrency regulations or explain the implications of a recent Federal Reserve decision, you position yourself as a trusted thought leader rather than just another advisor.

To ensure your content hits the mark, audit your audience's pain points through surveys and analytics. Then, map your content to these specific challenges. Every piece you produce should connect back to your core themes, creating a consistent narrative and making it easier to batch-create content efficiently.

With your topics defined and AI drafts in hand, the next step is to streamline your publishing process.

Set Up Your Publishing Workflow

Streamline your efforts by connecting all your tools into a unified workflow. Platforms like Buffer or HubSpot can automate and schedule content across multiple channels, cutting manual effort by about 70% [6]. Use AI to repurpose long-form content into bite-sized formats - turning a blog post into email sequences or LinkedIn threads - so you’re not starting from scratch every time.

Adopt a batch-creation approach. Dedicate time each month to draft multiple pieces of content using AI, then schedule them across the calendar. This ensures consistency, even during hectic weeks.

Track performance with simple dashboards. Tools like Google Analytics can give you insights into engagement rates, time spent on pages, and conversions. Review these metrics weekly to see what’s resonating and where adjustments are needed. Remember, the goal isn’t to launch perfect content but to improve consistently over time. As Reid Hoffman, Co-founder of LinkedIn, famously said:

"If you're not embarrassed by the first version, you launched too late." [3]

How to approach the Founder-led GTM strategy in 2024 & beyond

Step 3: Connect With Your Audience

With your content system ready to scale, the next step is to actively engage with your audience.

Pick the Right Channels

In the financial services space, LinkedIn is a standout platform for founder-led marketing. It's the go-to hub for professionals seeking trusted advisors and industry insights. Your personal LinkedIn profile - not just your company’s page - should be your primary focus. Engaging directly as a leader builds trust and positions you as an approachable expert.

Dedicate 30 minutes a day to LinkedIn activities: reply to comments, share quick takes on market trends, and participate in discussions within relevant groups. Aim to post 2-3 well-crafted pieces weekly. This frequency allows you to deliver thoughtful insights without feeling rushed or overwhelming your audience.

For deeper dives, turn to YouTube. Use it to create educational videos that break down complex topics, such as how Federal Reserve policies impact retirement strategies or the implications of new SEC regulations. These videos can establish long-term credibility and be repurposed into bite-sized clips for LinkedIn.

Finally, email is a powerful tool to nurture leads and maintain direct communication with prospects. It’s perfect for sharing in-depth financial advice. Keep your focus on these core platforms - spreading yourself too thin can dilute your message and complicate compliance tracking.

Share Your Experience and Insights

Your personal journey is a powerful tool for connecting with your audience. Consider the example of Melanie Perkins of Canva, who shared on LinkedIn about enduring over 100 investor rejections and the financial struggles of building her company. This openness not only resonated with her audience but also helped foster a community that played a role in Canva’s $26 billion valuation [1]. Personal stories like this build trust far more effectively than polished corporate messaging.

As mentioned earlier, being genuine is essential. Your story should be the foundation of your content strategy. Focus on four key themes: industry insights (e.g., how upcoming banking regulations may impact small businesses), behind-the-scenes decision-making (e.g., why you developed a particular feature), educational content (e.g., simplifying complex compliance rules), and anonymized success stories.

Stick to the 80/20 rule: dedicate 80% of your content to providing insights and education, and the remaining 20% to subtle, product-related mentions. For instance, instead of saying, "Our tool helps with compliance", try, "Here’s what we learned while navigating SEC compliance - these lessons shaped how we designed our platform." This approach frames you as a knowledgeable expert, not just someone promoting a product.

Don’t forget to include compliance disclaimers in your bio and posts, such as "Not financial advice" or "For educational purposes only." For posts discussing specific investment strategies or market predictions, have your legal team review the content to ensure alignment with FINRA and SEC guidelines. The goal is to share your expertise responsibly.

Try Interactive Content Formats

Interactive formats, like live sessions, are a great way to build stronger connections with your audience. Host monthly LinkedIn Live events or YouTube webinars on relevant topics, such as "2026 Fintech Trends" or "Ask Me Anything About Retirement Planning." Afterward, repurpose these recordings into shorter clips or blog posts to maximize their impact.

During these live sessions, focus on addressing your audience’s specific challenges rather than pitching your services. For example, a Q&A session tailored for small business owners could tackle tax-efficient investment strategies, while one for startup founders could explore equity compensation planning. These formats let you demonstrate your expertise while directly addressing real-world concerns.

Record every session and extend its reach through follow-up email campaigns and social media posts. Personal follow-ups with attendees who asked questions can turn casual viewers into long-term clients.

Interactive formats tend to generate higher engagement than traditional corporate messaging. They create a dialogue rather than a monologue, making your audience feel heard. Start with one live session per month, track metrics like attendance and follow-up interactions, and refine your approach based on what resonates most with your audience.

Step 4: Track Results and Improve

Once your engagement strategies are in place, the next step is all about fine-tuning. This means closely monitoring your results to ensure your efforts align with both compliance requirements and market goals. But don't just chase impressive-looking numbers - focus on metrics that truly guide your decisions. For financial services founders, the key metrics fall into three groups: leading indicators (early signals like email open rates and social engagement), impact metrics (bottom-line figures such as cost per qualified lead and customer acquisition cost), and efficiency metrics (system performance measures like automation rates).

Monitor the Numbers That Matter

Start by tracking early engagement metrics such as email open rates, click-through rates (CTR), and social interactions like comments or direct messages. These numbers reveal whether your content is striking the right chord. Then, shift your attention to metrics that directly affect your bottom line - cost per qualified lead (CPQL), customer acquisition cost (CAC), and lifetime value (LTV). These provide a clearer picture of your return on investment.

For example, in 2025, Mashreq Bank achieved impressive results by leveraging AI-driven personalization. Their tailored marketing efforts led to a 16% increase in debit card activations and a 50% boost in CTR [Source: Averi AI Financial Services Guide, 2025]. This highlights the importance of not just tracking metrics but acting on them promptly.

To stay on top of your data, set up automated weekly reports and real-time alerts for campaigns that hit specific benchmarks, like a 5% conversion rate. Short, 15-minute weekly reviews with your team can help you quickly assess what’s working, identify bottlenecks, and adjust your tactics.

Learn From Your Data and Customer Input

While numbers tell part of the story, qualitative feedback from customers adds depth. Review call transcripts and demo recordings to uncover recurring issues, pricing objections, or feature requests. AI tools can help analyze these conversations, surfacing trends that might otherwise go unnoticed. This deeper insight allows you to refine your messaging and address customer concerns more effectively.

Dive into your engagement data to pinpoint which content themes resonate most. For example, if certain topics consistently drive shares and comments, double down on those areas. Similarly, for conversion metrics, reallocate your budget toward channels that attract high-value prospects.

For broader visibility, track keyword rankings and mentions in AI systems like ChatGPT or Perplexity. Update underperforming content to improve its search performance. This is a core component of a multi-channel AI content engine that maintains strategic alignment while scaling output. On the compliance front, keep an eye on audit trail logs and flagged content, adjusting automated filters to stay aligned with SEC or FINRA guidelines. These steps ensure your content remains both effective and compliant.

Update Your Approach Regularly

Marketing is an ongoing process of testing and refining. If a specific topic or format performs well, focus more on it. On the flip side, if something underperforms despite a fair trial, don’t hesitate to pivot and try something new.

One B2B tech company, for instance, used AI-based subject-line testing and saw a 22% increase in email open rates [7]. Incorporating AI tools into your strategy can help you make incremental improvements that add up over time. By integrating your AI marketing manager with your CRM and analytics platforms, you can create an automated reporting system that highlights trends - what’s improving, what’s declining, and why - giving you a clear roadmap for adjustments.

"AI doesn't replace your marketing team - it unlocks their potential." - WSI [7]

The key is to keep evolving. Use integrated analytics to review your strategy monthly, make necessary adjustments, and continue experimenting. The more you refine your approach, the smoother your system becomes - and the better your results will be.

Conclusion

Founder-led marketing in financial services isn't about striving for perfection; it's about fostering trust and staying consistent. Adam Holmgren, CEO and Co-founder of Fibbler, put it best:

"Founder-led is not a content strategy. It's a trust strategy." [5]

Your audience doesn’t crave polished corporate language - they want to connect with the person behind the brand, someone who understands their financial hurdles and can offer guidance through complex decisions.

Striking the right balance between structure and flexibility is crucial. Start by auditing your online presence, defining what sets you apart, and creating a scalable content system. Let AI tools handle tasks like research, drafting, and optimization, so you can focus on strategy and injecting your personal insight. With 71% of consumers expecting personalized experiences, and educational content increasing the likelihood of a purchase by 131% [8], the value of this approach is clear.

Don’t get stuck chasing perfection. As Reid Hoffman famously said:

"If you're not embarrassed by the first version, you launched too late." [3]

Launch a Minimum Viable Campaign, measure what matters - like cost per qualified lead, customer acquisition cost, and engagement metrics - and refine your efforts using real-world data. Companies that move quickly to market can capture up to 70% more market share than slower competitors [3].

The strength of founder-led marketing lies in its agility. You can pivot swiftly in response to changing market conditions or new regulations without being bogged down by lengthy approval chains. Stick to the 90-10 value rule: 90% educational content, 10% promotional [4]. Focus on 3–4 core themes that align with your expertise and build a sustainable routine - spend 30 minutes daily engaging with your audience, 2–3 hours weekly creating content, and half a day each month on strategic planning.

FAQs

How do I stay SEC/FINRA compliant while posting as a founder?

To remain compliant with SEC and FINRA regulations, your posts must be fair, balanced, and free of misleading information. Always include clear disclosures, steer clear of unsupported claims, and adhere to advertising rules. When making performance claims or working with influencers, the SEC emphasizes the need for full transparency. Consider leveraging tools to automate disclosures and streamline review processes, ensuring your content consistently meets regulatory standards. Prioritizing transparency and adhering to these guidelines will help maintain compliance with both FINRA and SEC requirements.

What should my first 30 days of founder-led marketing look like?

To create a successful marketing strategy, start by clearly defining your campaign goals, identifying your target audience, and crafting key messages that resonate. Leverage AI tools like Averi to simplify content creation and manage workflows efficiently. Focus on connecting with your audience through genuine storytelling to foster trust and loyalty. Continuously monitor performance metrics and adjust your strategy based on feedback. This approach keeps your marketing adaptable, genuine, and in sync with your company’s vision for sustainable growth.

What metrics best demonstrate ROI for founder-led content?

Metrics such as customer acquisition cost (CAC), conversion rate, and customer lifetime value (LTV) are key indicators for evaluating ROI. These metrics provide a clear picture of the financial outcomes and effectiveness of founder-led marketing strategies, offering insights into both operational efficiency and the enduring value of your efforts.